The latest UK Budget, announced earlier this week, seems to spell bad news for businesses hoping for another reprieve from the incoming IR35 changes.

The changes to the IR35 rules will mean contractors must pay income tax and national insurance contributions in the same way as full-time directly employed staff. The new regime also means it is now the responsibility of the companies hiring contractors to assess whether these workers fall “within” IR35.

The update to the rules was originally meant to come into force in April 2020, but this was delayed by one year because of the effect of the Covid-19 pandemic, to 6 April 2021.

At the time of the delay, Chief Secretary to the UK Treasury, Steve Barclay, insisted this move would only be a deferral, and that the changes had no chance of being scrapped. The UK government now appears to have made good on its promise, with no mention of a further delay in documents associated with the Budget.

What’s more, HMRC indicated back in January that there would be no further delay to the rule changes. Despite pressure from senior figures in the UK recruitment sector, at the time of writing, it seems 6 April is deadline day.

Changes and solutions

This is where we, as expert tech and digital recruiters come in. Having formed RedCat back in 2000, we are experts in digital recruitment, and have a wealth of experience in contract recruitment, especially in the tech industry.

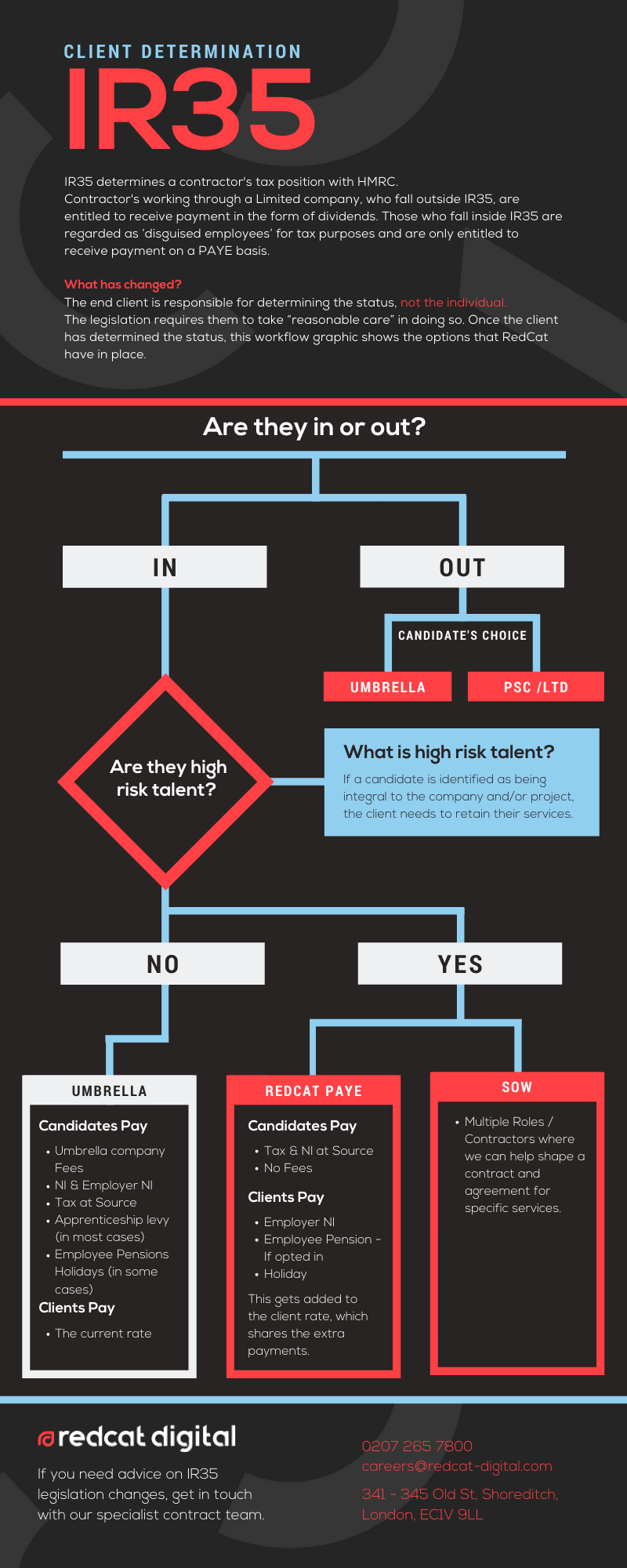

We’ve put together a workflow tool to help businesses understand what they need to do following the IR35 changes. Perhaps the most important thing to remember is that you – as the end client – is responsible for determining a worker’s status, not the individual.

In a nutshell, IR35 determines a contractor’s tax position with HMRC. Contractors working through a limited company, who fall outside IR35, are entitled to receive payment in the form of dividends. Those who fall inside IR35 are regarded as ‘disguised employees’ for tax purposes and are only entitled to receive payment on a PAYE basis.

As already covered, the new aspect is that the end client is responsible for determining the status, not the individual. The new legislation requires companies to take “reasonable care” in making this determination. Once you – as the client – have determined the status of the contractor, Our new workflow graphic shows the options that the team at RedCat has put in place.

The options

As the diagram below illustrates, there are a few options available.

The first thing to do is for you to decide whether the candidate falls inside or outside the IR35 rules. If the answer is “outside”, the candidate gets two choices: umbrella or PSC/Ltd.

If the answer is “inside” – meaning the company has decided the new IR35 rules do apply, the next question to answer is whether the candidate is considered “high-risk talent”. High-risk talent means: if a candidate is identified as being integral to the company and/or project, the client needs to retain their services.

If the answer is no – the candidate is not considered high-risk talent – RedCat suggests the “Umbrella” option, under which candidates pay: Umbrella company Fees; NI & Employer NI; Tax at Source; Apprenticeship levy (in most cases); Employee Pensions; Holidays (in some cases), while you as the client pay the current rate.

If the answer is yes – the candidate is considered high risk – we suggest two options: the RedCat PAYE or Statement Of Work.

Under the first, candidates pay Tax & NI at Source and No Fees, while clients pay Employer NI; Employee Pension – If opted in, and holiday. These get added to the client rate, which shares the extra payments. The latter option – Statement of Work – is for where there are multiple roles or contractors where RedCat can help shape a contract and agreement for specific services.

It’s clear that the changes are going to cause some disruption to the contractor hiring process: the best way to smooth out that disruption is speaking to the expert contract recruitment team at RedCat.